Welcome To Trinity County Appraisal District

PLEASE CALL AND VERIFY PRIOR YEAR TAX AMOUNTS BEFORE MAKING A PAYMENT.

Property Search

Property Search

Launch

Forms

Forms

Launch

Contact Us

Contact Us

Launch

Online Portal

Online Portal

Launch

Escrow Check

Escrow Check

Click HereWithin this site you will find general information about the district and the ad valorem property tax system in Texas, as well as information regarding specific properties within the district.

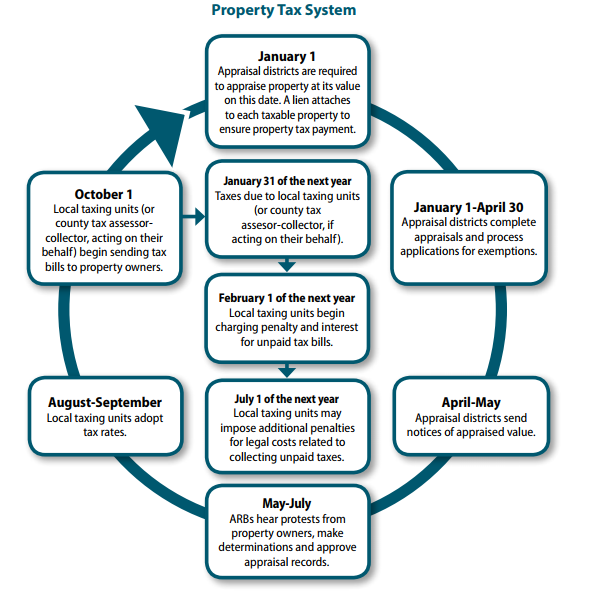

Trinity County Appraisal District is responsible for appraising all real and business personal property within Trinity County. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of Professional Appraisal Practices (USPAP).

Tax rates and ultimately the amount of taxes levied on property are determined by governing bodies of each of the taxing authorities.

Trinity County Appraisal District is responsible for the fair market appraisal of properties within each of the following taxing entities:

Taxing Entities:

| Trinity County | City of Groveton |

| City of Trinity | Trinity Memorial Hospital District |

| Westwood Shores MUD | Apple Springs ISD |

| Centerville ISD | Groveton ISD |

| Kennard ISD | Trinity ISD |

The duties of the appraisal district include:

The determination of market value of taxable property

The administration of exemptions and special valuations authorized by the local entities and the State of Texas

Tax Code Section 26.04(e-2)

VISIT Texas.gov/propertytaxes to find a link to your local property tax database. From this site you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

Property owners may request from the county assessor -collector for the county in which the property is located, contact information for the assessor for each taxing unit which the property is located who must provide the information described in this section to the owner on request.